Tech Acquisition to Address Market of More than 50 Billion

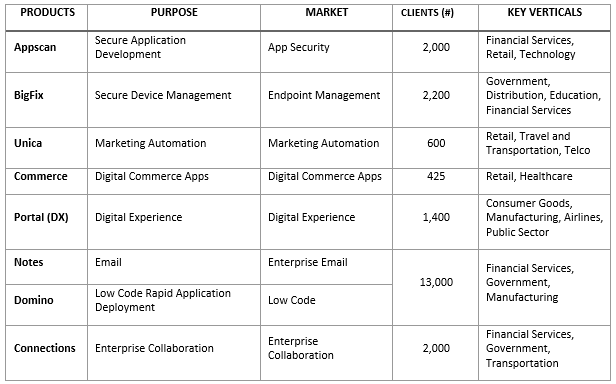

HCL Technologies will acquire select IBM software products for $1.8b. It is also the largest acquisition by an Indian IT services provider to date. The transaction is expected to close by mid-2019.

HCL's association with IBM as a development partner for five of the seven acquired products should have equipped HCL with know-how and better visibility on monetizing the acquired assets. It is a mutually beneficial arrangement for IBM and HCL as their long-term bond will continue, and both the companies will sell each other's technologies.

Source: https://blog.marketsandmarkets.com/hs-fs/hubfs/IBM%20Products%20Acquired%20by%20HCL.png?width=900&name=IBM%20Products%20Acquired%20by%20HCL.png

Impact on Existing Customers

All seven products are directly catering to at least one of the following key focus verticals of HCL:

Financial Services

Retail and Consumer Packaged Goods (CPG)

Telecom

The acquisition of seven IPs / Products from IBM seems to perfectly back HCL's five-year plan to boost the revenue share of high-margin business and overtake as the second largest IT player in India in terms of revenue. Opportunities through large-scale deployments of obtained products will allow HCL to connect and cement its relationship with thousands of clients worldwide.

Nevertheless, the significant question in the minds of the company’s stakeholders and industry analysts is "How will HCL, a software services firm, successfully transform into a software product firm to the best of its obtained client base and shareholders?” HCL's management holds the key with a clearly effective plan to make room for and monetize acquired assets and clarity on potential risks in client base erosion. At present, the HCL management has a task to give confidence that HCL could turn the obtained select products of IBM into a lucrative investment for its stakeholders.

For Commerce Customers

IBM WebSphere Commerce, including the recently released V9 as well as IBM Digital Commerce, are both moving to HCL. This means, after the deal closes, IBM will no longer have a commerce platform. All related IBM commerce contracts will move to HCL, and HCL will possess the future road map and any decisions about the platform’s long-term support and end of life.

Software Strategy

Since HCL is now into the software space, a space in which competition will differ from traditional markets.

Although these products have robust technology and an established customer base that has made major investments in them over the years and would be glad to see them get a new lease on life, they are aging, and face competition from the latest products in the market.

For those clients that are already moving from these IBM products to recent ones, HCL can also develop a transformation program to keep those customers and grow its customer base further.

HCL will need to resolve issues such as “lack of user-friendliness” that cause negativity for these products and the insufficient talent to continue supporting them.

It will need to articulate a consistent strategy for reviving these products and take that message to customers and lay out an understandable plan for integrating these products into its more extensive portfolio.

Royal Cyber

Royal Cyber is fully committed to working with IBM, HCL and our clients during this acquisition to fully understand how it affects our clients. We help companies interpret these trends and align them with their business objectives to help establish plans and roadmaps that meet short and long-term needs. We are here to explain how this acquisition may impact your commerce plans. If you have any questions or would like to talk with one of our commerce experts, please contact us at [email protected]